Creating Workplace Benefits for Freelancers: Winning Presentation for Rotman Business Design Challenge

RDC is the premier innovation and design case competition. Our team was comprised other MBA students, cofounders of the Innovation and Design Club.

Fidelity asked us to think about the implications of student loan debt, generational wealth transfer, and people supporting both their parents and children.

Instead, we were intrigued by the rise of the freelance economy and the implications for Fidelity's workplace benefits business.

Fidelity asked us to think about the implications of student loan debt, generational wealth transfer, and people supporting both their parents and children.

Instead, we were intrigued by the rise of the freelance economy and the implications for Fidelity's workplace benefits business.

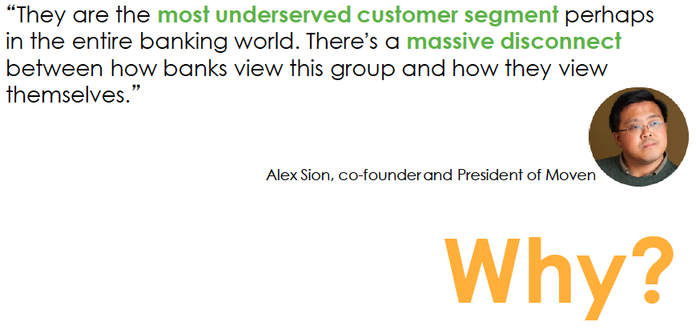

In doing secondary research on what benefits and banking look like for freelancers, we uncovered a surprising fact:

Freelancers earn more on average but are the underserved by banks.

This gave us a great research direction that might be both rich from a user perspective and meaningful to Fidelity's business model.

Freelancers earn more on average but are the underserved by banks.

This gave us a great research direction that might be both rich from a user perspective and meaningful to Fidelity's business model.

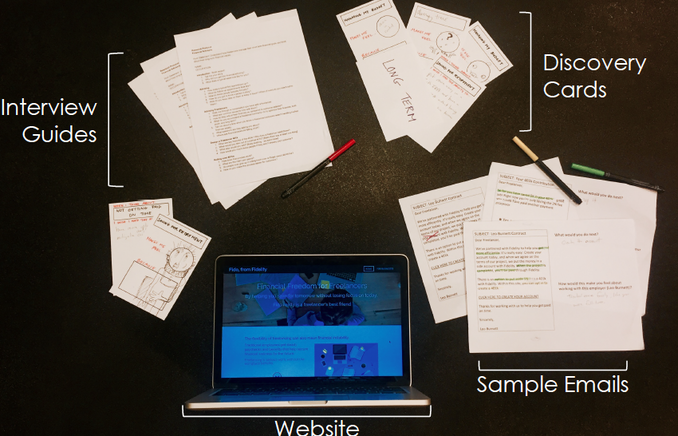

The team interviewed a number of freelancers, financial advisors, and folks who hire freelancers.

We developed materials to elicit a deeper understanding of how freelancers view finances and created several iterations of prototypes to get better feedback and accelerate our understanding of what might be valuable to freelancers.

We developed materials to elicit a deeper understanding of how freelancers view finances and created several iterations of prototypes to get better feedback and accelerate our understanding of what might be valuable to freelancers.

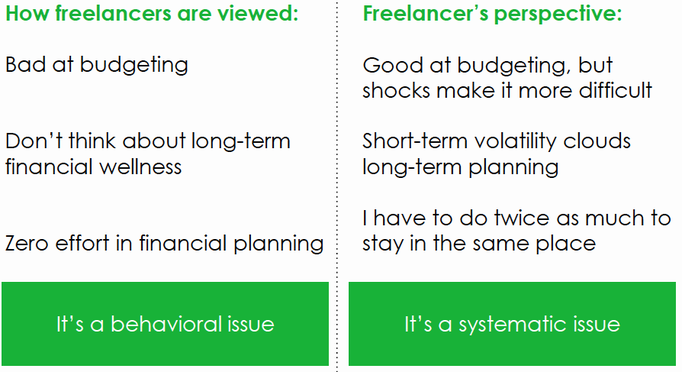

We uncovered that, while freelancers are viewed as uninterested in long-term financial wellness and bad at planning, freelancers see things quite differently.

The nature of how they get paid makes it harder to get paid on time and creates more cash flow volatility, which creates the need for a larger cash buffer, making it much harder to save for the future.

The nature of how they get paid makes it harder to get paid on time and creates more cash flow volatility, which creates the need for a larger cash buffer, making it much harder to save for the future.

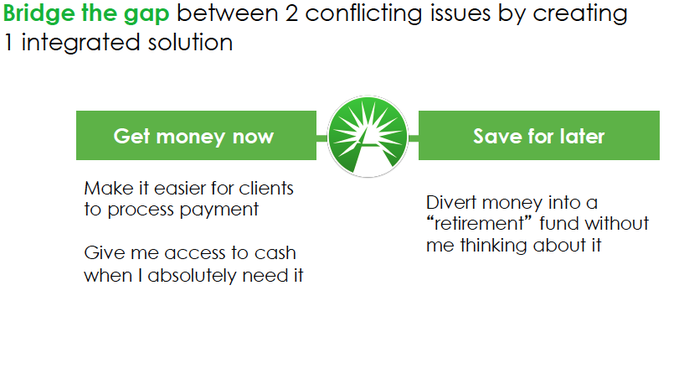

With these insights in hand, we recognized that a great solution would help freelancers get paid on time, and automate the process of saving for the future.

In other words, we wanted to create workplace benefits for people with nontraditional workplaces.

In other words, we wanted to create workplace benefits for people with nontraditional workplaces.

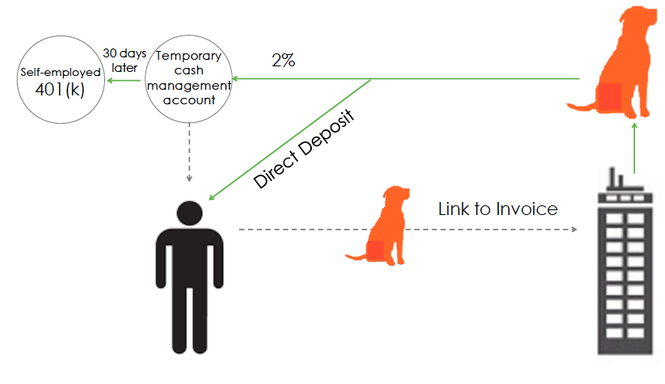

Our concept, FIDO, is an invoicing platform that integrates with the top payment systems, making it easy and seamless to process a payment from the client perspective.

When the freelancer gets paid, a small percentage is automatically held back in a cash account for 30 days (a normal bill cycle), where it is accessible as cash if the freelancer needs a little extra.

After 30 days, the cash is automatically invested in securities, helping the freelancer save for the future.

When the freelancer gets paid, a small percentage is automatically held back in a cash account for 30 days (a normal bill cycle), where it is accessible as cash if the freelancer needs a little extra.

After 30 days, the cash is automatically invested in securities, helping the freelancer save for the future.

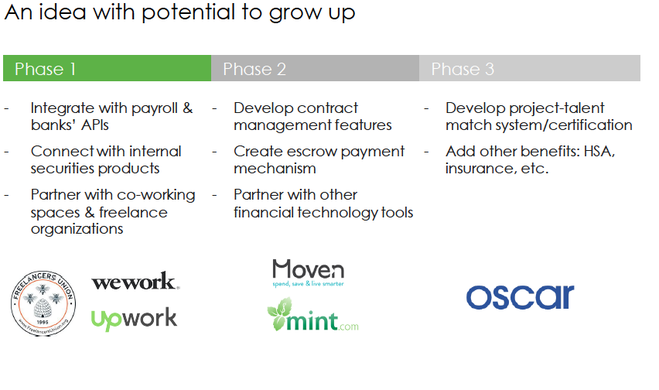

We loved the FIDO platform because it could easily expand into additional workplace benefits, like healthcare, which is a real pain point for freelancers, and an area that Fidelity has recently expanded into.

FIDO has history on gig completion and payment timelines, there is an opportunity for freelancers and those looking for their talents gain trust and connect more quickly through the platform.

FIDO helps Fidelity move its workplace benefits business into the freelance economy and helps freelancers attain financial wellness.

FIDO has history on gig completion and payment timelines, there is an opportunity for freelancers and those looking for their talents gain trust and connect more quickly through the platform.

FIDO helps Fidelity move its workplace benefits business into the freelance economy and helps freelancers attain financial wellness.